Why Understanding the Endowment Effect is the Key to Selling Anything

Ever wondered why selling a professional service seems much harder than getting people to exchange cash for a tangible product?

Surprisingly, the reason drives issues such as compulsive acquisitiveness and hoarding, and even irrational investing. It influences everything from economics to law.

The same hard wiring in our primal brains drives this irrational behaviour. It also has implications for selling everything, from tangible products to services and even the need to pay taxes!

Once someone owns something, he places a higher value on it than he did when he acquired it—an observation first called ‘the endowment effect’ approx. 30 years ago by Richard Thaler.

‘We value more highly things we own than things we don’t own.’

‘Most people demand higher price to give up an item than they would be willing to pay for it’

Mankind’s inner chimpanzee refuses to let go

In one experiment, people demanded a higher price for a coffee mug that had been given to them but put a lower price on one they did not yet own.

People are reluctant to trade what they have for a promise to receive something else from a stranger.

Whether this is irrational or not depends on the circumstances of the trade.

Humans, like our primate ancestors, really don’t like losing things. In fact, we get much more emotional about losing things than we get happy about gaining things.

Some psychologists think that the endowment effect results not from loss aversion but from a sense of possession, a feeling that an object is ‘mine’. Ownership creates a bond between the item and the self, and this increases the value of the item.

We humans are not perfect calculators. Instead, we overvalue our possessions because they contribute to our identity and the identities of the groups we belong to. We don’t overvalue goods because we’re loss averse; we overvalue goods because they are part of who we are.

How it affects investing

The endowment effect has immediate implications for investors.….the tendency to ‘love what you own’ applies to the shares, bonds and funds in your portfolio. We have a natural tendency to be lenient on evaluating the performance of investments we own. If the market says our stock is worth $10, we think it’s worth more even before we perform any analysis whatsoever. Not surprisingly, this bias does us a disservice. In order to overcome the endowment effect, we need to equally scrutinise both what we own and what we don’t.

Losses are perceived as 2.5 times more powerful than gains

While a piece of timber saved for a possible future project might cost only $1, in the hoarder’s mind, it is worth much more. Studies estimate perhaps $2.50. If the timber is disposed of, but then later needed for a project, the perceived price to replace it in the future could become even higher, if the cost of time to get it is considered.

Hoarders – those for whom parting with possessions is more painful

Once hoarders have acquired something, even worthless junk, they value it highly.

It becomes hard for many to give up an object. “Thanks to the endowment effect, it is so much easier to convince yourself that a high income justifies buying expensive things rather than throwing away cheap ones.”

While there may be many books, stuffed animals or DVDs that are exactly the same as the ones stuffed in your closet, there’s something special about the copy you own specifically because it’s yours.

Armed with knowledge of the endowment effect’s pull on our psychology, Mind Hacks calls for the enlightened hoarders to ask themselves: “If I didn’t already own this, how much effort would I put in to buying it?”

Acquisitiveness

Decisions to acquire and discard everyday goods differ across frames, items, and individuals. In a society where material resources are superabundant, people routinely struggle with the fact that goods are attractive and easy to acquire, but hard to manage and discard.

Selling products and services

The endowment effect explains why people are much more price-sensitive when buying a service than a physical product they can take away with them. At least when buying a product, you balance handing over cash with acquiring the product and your brain walks away happy.

So while a person will happily pay big $’s for luxury goods they don’t need, they will be miserly when considering paying for a service even if they believe it might benefit them greatly.

US Retail chain Nordstrom, overcomes the endowment effect by offering unconditional returns.

Accountants, lawyers and other professional service providers need to work very hard to sell the benefits of their particular services. Otherwise they fall into the ‘necessary evil’ category, along with taxes. And yet they are renowned for being generally devoid of selling skills!

We can’t fight the primal endowment effect. Instead we need to work out what other, stronger human need our service appeals to.

The security industry benefits from their service being aligned with the endowment effect, assisting us keep what we already have.

Tax collection authorities need to explain where these taxes go, work diligently to remove real and perceived waste, so we feel better about parting with our assets. Things like health, national security and even a social safety net are critical, yet the waters are so muddied by all the peripheral activities governments allocate our taxes to; and then there’s the waste…

Prostitution services is an interesting one…..clearly other primal human instincts are even stronger than the endowment effect!

Tips for when presenting, say, a business sale marketing budget

Our brains’ hard wiring explains why business owners will naturally want to skimp on the sale marketing budget.

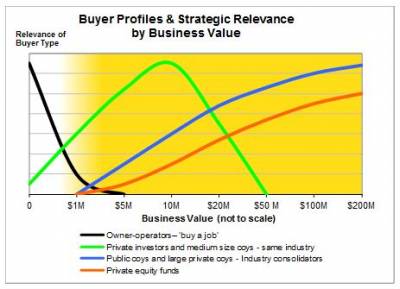

Clients may strive to save a few thousand dollars in the marketing phase, only to give away tens of thousands of dollars during negotiations with a single buyer, when just one more buyer could have made a huge difference to the outcome. We have to be specific about how much stronger the process will be when we attract a larger contingent of targeted buyers.

We must highlight the expected benefits, including increased certainty of a result, a higher price and a wider range of possible outcomes.

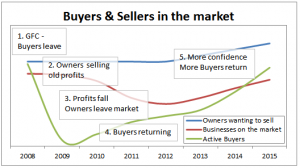

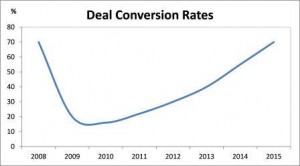

Market instability from 2008 caused deal conversion rates (sales completions to total sale engagements) to plummet. Recently growing confidence, greater stability and market balance has brought the conversion rate back up to pre-GFC levels.

Market instability from 2008 caused deal conversion rates (sales completions to total sale engagements) to plummet. Recently growing confidence, greater stability and market balance has brought the conversion rate back up to pre-GFC levels. This explains why Divest Merge Acquire is tracking for a record year, with substantial deals completing across Australia, including Adelaide, Darwin, Sydney, Brisbane and many places in between.

This explains why Divest Merge Acquire is tracking for a record year, with substantial deals completing across Australia, including Adelaide, Darwin, Sydney, Brisbane and many places in between.