M&A means Mergers and Acquisitions. It also covers business sales/divestments, as most strategic businesses sold are ‘merged’ into larger businesses as strategic bolt-ons, hence the ‘M&A market’.

The M&A market is an early indicator of business confidence, as there are virtually no lags before buyers either come or go. Buyer volatility is the key variable in the M&A market.

The good news is that business confidence is relatively high, which has been driving the market for business sales and acquisitions over the past year.

Our own stats show M&A activity has been progressively growing stronger since the last federal election. We don’t think it’s a coincidence, as conservative federal governments generally engender greater confidence by creating greater stability (or at least the perception of it). M&A activity is stronger despite the continuing fragility of many industries and the economy generally.

The reason for this is because strong M&A activity requires stability to bring buyers out. Stability is vital. Even stable under-performance is more conducive than volatile growth and uncertainty, which drive buyers away. Investors need to know how target businesses are performing and are likely to perform, and they can’t assess that against a backdrop of volatility where historic performance is irrelevant and the future is unknown.

It’s not plain sailing, however. On an industry by industry basis, the languishing resources and manufacturing sectors have become difficult to finalise deals in. Even importers are finding the going tough, with ongoing quality issues and, more recently, exchange rate movements. However niche manufacturers remain popular, especially those with substantial long term contracts and maintenance-related recurring revenue streams. Construction businesses are also performing more strongly on the back of a housing and infrastructure resurgence.

The long term picture for business sale transactions is positive, as the majority of baby boomers are now in their 60’s and heading to retirement. This is creating a target-rich environment for strategic investors. It also tends to keep EBIT multiples in check and this pressure is set to continue. However, owners’ expectations are now more realistic and many can afford to sell at today’s prices because they have worked longer than expected and have made up the value shortfall in additional profits rather than placing all bets on a massively happy, tax-effective ending. Their super accounts are also replenished after having been routed in the GFC.

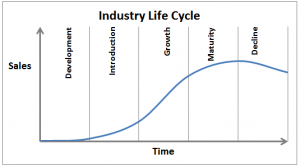

There’s another complication too. Businesses operate in industry sectors that each has life cycles as in the following chart.

Most retiring baby boomers have been running traditional businesses in mature industries, some of which are in long term decline.

Businesses being sold are usually acquired by the following generation’s entrepreneurs. There is an emerging structural mis-match between the types of businesses for sale and what buyers will be looking for. Younger buyers are attracted to new business models and will progressively shun the old-style business models of their predecessors.

However, industry consolidators moving into mature markets capitalise on the high volumes and strong demand, extracting efficiencies and profits from traditional low risk sectors. They prolong and extend the life cycles and build major industry groups as substantial cash cows that they can either on-sell or retain and milk for many years. They can also bring innovation that extends or even reinvigorates industries. Bolt-on acquisitions are the staple diet of these business aggregators. They disappeared during the GFC but are now back in droves.

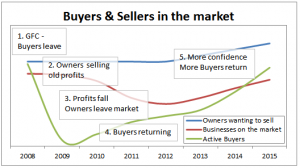

Here are more charts that explain what’s happened and is happening.

The past 6 years in the M&A market has been punctuated by the following events:

- GFC – buyers leave the market en-masse and virtually overnight;

- Owners linger in the market and try and sell based on old profits that are now meaningless;

- As profits and business values fall, owners also leave the market and retreat to their businesses to rebuild;

- Buyers start venturing back after the market has bottomed out and confidence starts to return. Many had their roll-up programmes interrupted and want to regain momentum;

- The 2013 change of federal gov’t brings greater confidence and accelerates buyer activity.

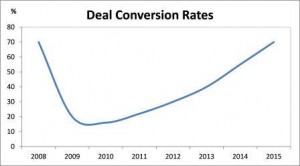

Market instability from 2008 caused deal conversion rates (sales completions to total sale engagements) to plummet. Recently growing confidence, greater stability and market balance has brought the conversion rate back up to pre-GFC levels.

Market instability from 2008 caused deal conversion rates (sales completions to total sale engagements) to plummet. Recently growing confidence, greater stability and market balance has brought the conversion rate back up to pre-GFC levels.

This explains why Divest Merge Acquire is tracking for a record year, with substantial deals completing across Australia, including Adelaide, Darwin, Sydney, Brisbane and many places in between.

This explains why Divest Merge Acquire is tracking for a record year, with substantial deals completing across Australia, including Adelaide, Darwin, Sydney, Brisbane and many places in between.

The strong M&A market and expectation that it will continue on a growth cycle are also behind our decision to open up our Aus/NZ member firm advisory network from the current 7 offices and franchises over the next 12 months. Coverage has already extended to the WA market, with the recent addition of a Perth-based Member Firm advisor.

Progressively more and more baby boomers’ businesses are coming onto the market, but the buyers will continue to come and go depending on business confidence at the time. Business owners intending to retire soon should be making the move when buyers are active. The buyers are active now, so Carpe Diem!