Acquisitions

DMA provides market leading M&A transaction capability for local and multi-national companies wanting to source and acquire targets.

Acquisitions Search

DMA is regularly engaged by local and multi-national companies looking for specific acquisitions targets. DMA’s level of involvement can be varied according to your requirements. DMA can act as lead or supporting advisor, with fee structures tailored to suit.

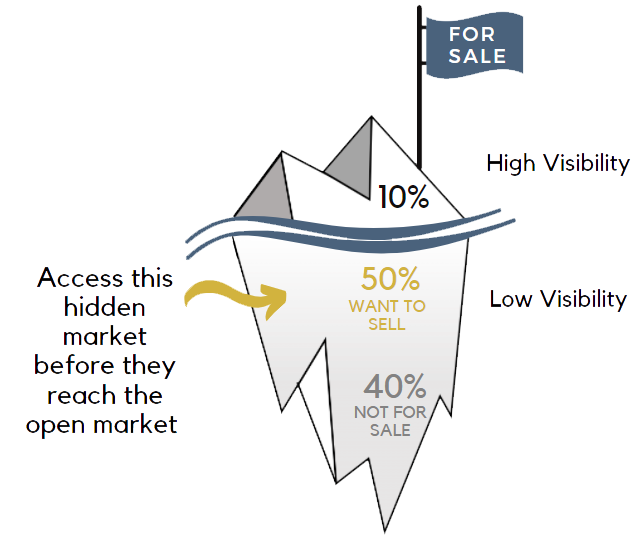

There are many benefits to a targeted acquisition search, including gaining access to the significant number of business owners who would like to sell, but do not want to actively put their businesses on the market and expose their staff and customers to a sale process. An added benefit is that, as they are not actively on the market, you are likely to be negotiating exclusively with the owners.

By virtue of its systems and database, DMA can identify and attract business owners to the prospect of a prompt and efficient sale of their business.

What DMA’s Acquisition Process Includes

![]()

M&A Acquisition Strategy

Understanding your acquisition strategy and target profiles

![]()

Document Preparation

Prepare marketing material, setting out the criteria and attributes of the target/s for your approval

![]()

Targeted Direct Marketing

Confidential and direct approaches to identified targets

![]()

Establish Protocols

Arrangement of appropriate confidentiality undertakings with targets who respond

![]()

Target Assessment

Obtain sufficient information from interested targets to assess their suitability

![]()

Negotiation

Qualifying, Questions and Inspections, leading to formal expressions of interest

![]()

Terms Agreed

Assistance with the formulation of an NBIO, (including assistance with indicative pricing for the target)

![]()

Contract to Completion

Assistance with final negotiations, satisfaction of conditions etc. Incorporation of key due diligence findings into transaction documentation.

Assistance through to completion.

Search for Prospective Targets

The most effective way to attract enquiries for your business acquisition is through a combination of confidential direct approach and targeted emailouts with your agreement.

Once engaged by you we will search throughout your target market, whether locally or internationally, for suitable acquisitions using our database of potential business targets, as well as our extensive local and global professional networks.

DMA has over many years, amassed an extensive database of information on large and medium enterprises.

DMA’s market standing and reputation bring trust and credibility to the process, making targets more receptive to our direct approach on your behalf.

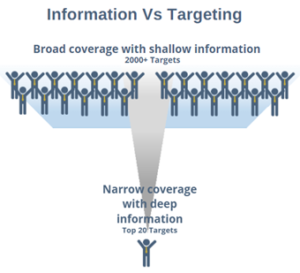

Broad & Shallow vs Narrow & Deep

DMA’s targeted marketing reach is both broad and deep. Whereas many M&A advisors have limited capacity and therefore limit their targeting to a narrow base of targets they ‘go deep’ on, DMA combines this with its unique capacity to ‘go broad’ to a much wider number of possible targets.

This system is well proven and delivers superior numbers of targeted responses on each client’s opportunity, safely and confidentially.

Some of Our Results

Transaction Details

Divest Merge Acquire advised the owners of Trescal in their successful acquisition of ASG-X Technologies.

Transaction Details

Divest Merge Acquire advised the owners of Trescal in their successful acquisition of the calibration business of Sudel Industries.

Transaction Details

Divest Merge Acquire advised the owners of Trescal in their successful acquisition of Celemetrix.

Transaction Details

Divest Merge Acquire advised the owners of Trescal in their successful acquisition of Mobile Test N Cal.

Transaction Details

Divest Merge Acquire advised the owners of Fencepac in their successful acquisition of Retaining Solutions.

Find Out More About Our Targeted Acquisition Search Service

Please contact us for a free, no obligation initial discussion with a qualified advisor to discuss your acquisition requirements.