Australia’s ageing population has consequences for business, and succession planning is fast becoming a major issue. Deciding on the best strategy for exit is crucial for would-be retirees to maximise proceeds on sale, and ensure a smooth transition to retirement.

Many in this situation do not know where to look for advice when starting this process. This article provides an overview of each of the exit strategies available, and is designed to be a springboard into detailed planning with your accountant/advisor.

The point of retirement for business owners is generally when they value their leisure time over making more money. The desire to exit may prompted by age, ill health, other pursuits, a long holiday, a change of career, the attraction of a new challenge, or simply that it is no longer a core business.

Owners usually want to hand the business over to those whom they believe will succeed. This may be because of loyalty to staff, to secure a long-term tenant for their freehold property, or just the desire to see the business continue indefinitely.

The business may be their baby, one that has been part of their family, providing their lifestyle, friends, social network, their passion, their way of living out their dreams, or simply an investment. Whatever it has been, they now want something else more.

This can be an emotional time for business owners. The letting go, an uncertain future, parting company with friends, leaving behind a way of life and handing over custodianship of their business.

Ways to Exit

The alternative ways to step off the treadmill are:

- Succession of Ownership – to children or other family members

- Succession of Ownership – partial or total Management Buy Out (MBO)

- Capital raising / IPO – for those businesses large enough to withstand the cost and due diligence process

- Merger with others

- Sell as a going concern

- Close and liquidate assets

Appeal of different exit strategies

This is how business owners say they would like to exit:

- 60%: Sell to a third party

- 30%: Family Succession

- 10%: Sell to management or staff

This excludes the ‘close and liquidate’ option which is more likely to apply only to smaller businesses.

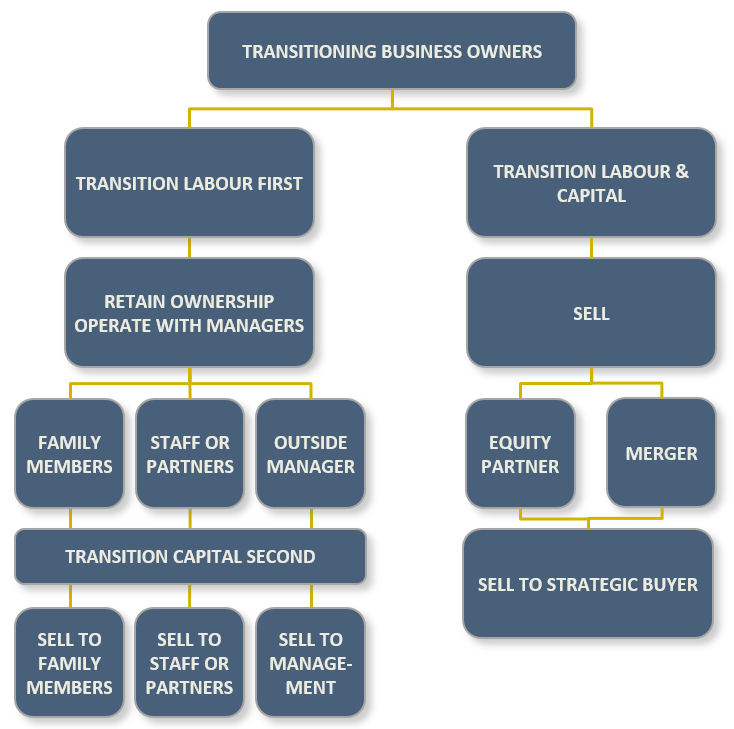

The flowchart below illustrates the various exit options available to Retiring Business Owners, to be discussed in further detail in this article:

Succession Plan

It takes careful planning and thought to achieve a graceful exit from your business, especially to someone you know.

The succession plan outlines how the critical roles in the business will be filled in the future. Before you can develop a succession plan, you need to know where your business is now, and where you would think it will be in the future.

The succession plan should deal with two main components, ownership succession and management succession:

- Ownership succession – Transfer of assets – transferring the wealth in the business to the designated successors.

- Management succession – Transfer of power – management and control of the business is transferred to the chosen successor. This is appropriate when the owners want to retain ownership but reduce or relinquish their role in its management.

In a sale to a third party, both are transferred together.

Ownership Succession

Because most owners expect the proceeds from sale to be important part of their retirement funds, they cannot afford to give away their businesses to their children.

Whether or not the owner is transferring the business to family members, they usually want the value they deserve out of the business selling. A professional valuation is needed even if selling to family members. Your accountant can usually arrange this.

Steps for a Smooth Succession to Family Members

Where the owner chooses to take no further part in the business, and transfers both ownership and control to his or her family, there are a number of considerations:

- Seek outside professional help – to navigate through the emotion that surrounds the process. An objective adviser can help resolve disputes and ensure that the decisions made are the best for both the family and the business.

- Hold a family retreat – a structured meeting with one or more generations, including spouses, after the concerns, wishes and aspirations have been identified from a one-to-one interview process.

- Write a Constitution – a document, prepared by your lawyer, that sets out the agreement between generations on a wide range of matters.

- Build in flexibility – The plan needs to be flexible enough to be changed if circumstances change.

- Family – The owner may want leave the business to the children in equal shares to avoid favouritism. But in most cases the children don’t work well together and arguments damage the business.

- Consider the Structure – Select an appropriate legal structure. For example, forming a family trust to own and operate the business may provide tax and other advantages, especially where the owner wants to gift the business to the children, but still run it through the trust.

It is important to provide for the ongoing, capable management of the business. It is imperative to place active ownership in the hands of those interested and capable of providing future direction, input and support to it. Multiple classes of shares and shareholder agreements can be used to match the specific objectives of family members with their rights to ownership prerogatives.

Some specific techniques which can be employed include:

- Separating ownership from management interests.

If the business is a company, different classes of shares can be issued to children not in the business which entitle them to dividends but not voting rights. - Directing or restricting subsequent share transactions.

The succession plan can include provision to deal with a family members’ desire to sell their shares. Specification of the mandatory buy-out of the shareholders’ interests, either through redemption or requirement to sell the shares, is a standard approach to handling this type of situation. - Limiting outside investors’ purchase of shares.

By using an agreement giving the family or company the right of first refusal before any shares can be sold, the business owner can reduce the opportunities for outside investors to purchase an interest in the company.

Management Succession

If a business owner wants to retire, but does not want to relinquish ownership of the business, he or she might appoint a family member, partner or manager to run the business. This has the advantage of continued involvement without the responsibility of dealing with the day-to-day running the business.

The options available in terms of selecting a manager for the business include:

- Choose a family member;

- Select a key employee;

- Form a committee of family members; or

- Bring in a manager from outside the business.

Considerations include:

- Letting go of the steering wheel. The owner must accept that he or she no longer controls the business. Handing over the reins can be the most difficult decision that an individual has to make in professional life. Many owners find it difficult to step back from a business that they have nurtured over the years and leave decisions to others. If they fail to step back, then they are not really retiring and the intending manager may become dissatisfied and frustrated.

- Determine the factors that are most essential to managing the company in an effective and efficient manner to facilitate continuing growth and development.

- Expectations and capabilities of senior executives.

- Have a clear timetable for succession. If you plan a phased approach, it is important both the incumbent and the successor are comfortable.

- Start early – Well thought out succession plans take time to develop and implement. If the change of control is to be successful and the business is to continue to prosper, it is essential to effectively plan and properly assess the situation. The replacement manager should be progressively trained and assume responsibility as they prove themselves.

- Qualification – qualifications and abilities of family members. Taking over the business by children should not be a right, but should be earned. The successor needs to qualify with appropriate experience. Assess whether family members have both the aptitude and interest necessary for running the company. Many parents find it difficult to properly assess their children’s management capabilities. A professional appraisal of both the existing and potential capabilities of the children should be carried out. This will benefit both the children, who should not be made responsible for something which is beyond their capabilities, and the parent, who may still be relying on income from a successful business.

- A Board – Set up a Board of Directors of suitably qualified non-family members. Provided the family members take advice from the Board, the business should be strengthened and many family arguments may be avoided.

- Continuing liability. If the owner continues as a partner or director he or she may become personally liable for debts incurred by the business, even if he or she had no knowledge of the debts.

- If more than one family member wants to take over, consider how the takeover should be organised and how the family members will work together.

Family Succession in Perspective

Only a small number of family businesses are actually sold or transferred to family members:

- 70% are either sold or closed after the retirement of the founder

- 30% are passed on to the second generation; and just

- 10% make the third generation

These low succession results point to the need for those who want to transfer to family members to plan early.

- 40% of owners have children they believe are capable of taking over the business.

- Only 20% believe their children are both willing and able to take the business over.

- If not sold outright, most owners prefer to retain some control and/or income from the business.

Fewer than 40% of business owners have succession plans. If family succession is intended, find out early if the children want this. Many more owners expect their children to take over than actually do. Most children want to make their own tracks in the snow.

Succession to Staff or Partners

Succession can also mean the sale of the business to loyal employees or to others who have worked with the owner for many years and whom the owners would like to give first choice of taking the business over.

Appointing a Manager

This allows the owner to retire from the running of the business without transferring ownership. It can be a useful interim step, provided safeguards are in place. Having a stable manager in place will usually make it easier to sell the business at a later stage.

Some of the issues associated with appointing a manager are similar to those found in leaving family members or partners to run a business. Care must be taken in setting the manager’s remuneration, level of autonomy and reporting responsibilities.

It may be necessary to offer the manager equity in the business as a personal stake in its success. This may be particularly important if it is intended to pass the ownership of the business to children with a manager in place. The children may not have the knowledge or interest to ensure that the manager is honest and is doing a good job. If the children have some aptitude for business but lack the time or interest to run it themselves, a mandate should be clearly established. Such an arrangement should recognise both the manager’s responsibility for day-to-day operation without interference and the family’s right to make policy decisions.

Where the owner has relinquished management but not ownership and the owner later decides to sell the business, he or she may not receive the same price as while still personally involved.

Conversely, some businesses thrive under new management and significantly increase in value. Either way, there is additional risk that needs to be taken into account.

Management Buy Out (MBO)

A Management Buy-Out is the purchase of a business by its management, usually in conjunction with an outside financier. Private equity MBO financing is where a business is purchased by its management team with the assistance of a private equity fund.

Buy-Outs vary in size, scope and complexity. The key feature is that the manager acquires an equity interest in the business, sometimes a controlling stake, for a relatively modest personal investment. The existing owner normally sells most or all of their investment to the manager and the financiers as co-investors.

This may be an option where the business has a management structure that can carry on the business without the owner and the MBO team has the financial capacity to structure the MBO funding.

Management Buy-Outs have a good success rate and can typically achieve significant returns for the owner/vendor.

Management Buy-Ins (MBI)

Management Buy-Ins occur when an external management team, usually in conjunction with outside financiers, purchases a business they do not currently run.

MBI teams can provide the key to unlocking a transaction for a vendor. Sometimes owners are keen to sell their businesses but don’t have the management teams willing or able to take the business forward.

Key success factors include:

- Strong experienced management team

- Commercial viability of the business

- Structure of the transaction

- Cash flows of the business

- Willingness of Vendor

Businesses tapping the private equity market often do not have sufficient collateral or a track record of profits to obtain bank finance.

The investment horizon for a private equity investor is usually between five to ten years. Exits are normally achieved by listing on the stock exchange through an initial public offering (IPO) or by the sale of the business.

While many private equity funds take a controlling stake, they can provide management advice and specific performance targets.

Buying the business you already run from a parent company or existing shareholder is an increasingly viable option with rewarding results for management. However, choosing the right financial partner to back you in this process is essential.

Part Sale to a Passive Equity Partner

There is plenty of money available for investment in good businesses. What is in short supply are people capable of running them.

The equity partner will be comforted by having the owner stay on to run the business. This may suit owners who want to unlock some of the capital invested in the business whilst maintaining an interest and an ongoing income stream.

Both parties must have an exit strategy. This may be by way of ultimate sale to a third party or the equity partner installing a manager before the owner retires.

An equity partnership may also be appropriate when some of the partners in a business are retiring and others want to stay on but can’t afford to buy the exiting partners’ shares.

Part Sale to an active Equity Partner

This involves the new partner assuming responsibility for the operation, with the original owner retaining a financial stake and involvement in the operation for a period of time, coinciding with the retention of part equity. There needs to be a phase out over an agreed period.

This may suit situations where:

- The owner wants to ‘pre-sell’ the business in preparation for ultimate retirement.

- The owner wants to maintain an interest in the day-to-day activities and the future success of the business.

- The incoming owner wants this additional security on handover to ensure a smooth transfer of the goodwill of the business.

Merger with a similar business

A merger is when two companies agree to go forward as a single operation rather than as separate entities.

The idea of the merger is that the owners or CEO’s agree that by merging they should both benefit more than by continuing alone.

Companies seek out other companies to see if the combination of the two will create a more competitive, cost efficient operation than either one currently is. The two companies should hold a bigger market share and achieve greater efficiencies through such a deal. A merger may also be advantageous to the organisations that are unable to survive independently.

Mergers may be driven by the need to create an organisation large enough to support a stronger management team than the separate organisations can justify. This may allow the respective owners to retire from the operation and achieve management succession. It may also set up a subsequent transfer of ownership through sale or MBO.

Some benefits come through from efficiency gains resulting from combining administration and other similar functions. There should also be better cost efficiencies and the combined group will end up with a much higher profile in the industry, which gives more confidence to those with whom the new operation deals.

A merger does not necessarily involve equals. If one company is much larger or smaller than the other a merger can still work.

Sell Outright

This is by far the most common way for owners to exit their business. With early baby boomers now retiring from their businesses, and with their children off doing other things in most cases, their only real exit strategy is to sell.

After the business is sold, the owner no longer needs to worry about it and this can be a great relief in retirement.

This strategy provides for the sale to the broader market of prospective purchasers. It also means the owner can negotiate a sale price through a competitive process without worrying about agreeing a price with family members.

The sale is often referred to as “The Big Transaction”, as it may be the single most important business transaction for the owner. It is essential to plan early, get the best possible advice and then proceed to the market with a clear understanding of how much you are likely to realise from the sale after tax.

When a business is sold on retirement the proceeds can be safely invested in a way that will ensure a sustained income for the remainder of the owner’s life.

One complicating factor in selling the business is that it may be difficult to sell without the involvement of the owner. For example, if there is no professional management in the business, the purchaser will be likely to want the former owner to stay on and operate the business for an agreed period of time.

Key rules when proposing a sale:

- Make sure the business is ‘sale ready’.

- Obtain a Business Valuation.

- Have an Information Memorandum professionally prepared.

- Make sure the business is properly marketed.

- Don’t try to negotiate the sale yourself.

Where to get help

Accountants are the most common source of professional advice for succession planning. Many Accountants have an excellent understanding of their clients’ businesses and are a logical first port-of-call when considering a possible sale, providing the platform from which other specialised services are sourced.

The family itself is a common source of help for many business owners.

Business Sale and M&A (Mergers and Acquisitions) Consultants/Advisors, such as Divest Merge Acquire, are often called on for involvement in the early stages of the planning process to coordinate an exit plan with you and your Accountant, and assist in preparing the business for an optimal exit.